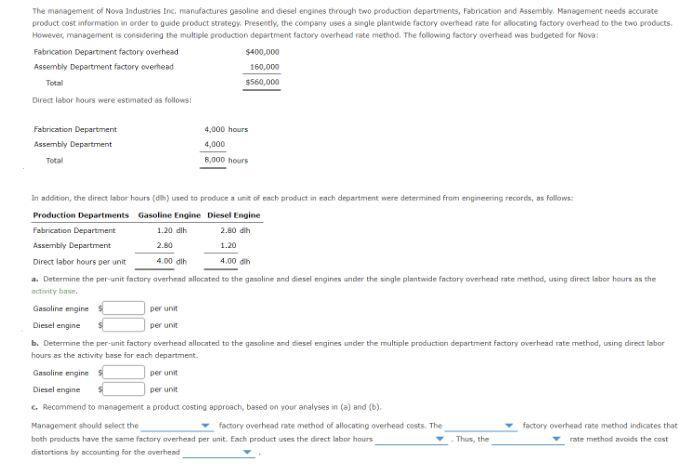

The management of Nova Industries Inc. manufactures gasoline and diesel engines through two production departments, Fabrication and Assembly. Management needs accurate product cost information in order to guide product strategy. Presently, the company uses a single plantwide factory overhead rate for allocating factory overhead to the two products. However, management is considering the multiple production department factory overhead rate method. The following factory overhead was budgeted for Nova:

Fabrication Department factory overhead........................................................$440,000

Assembly Department factory overhead............................................................200,000

Total.........................................................................................................................$640,000

Direct labor hours were estimated as follows:______.

Fabrication Department................................................................4,000 hours

Assembly Department....................................................................4,000

Total..................................................................................................8,000 hours

In addition, the direct labor hours (dlh) used to produce a unit of each product in each

department were determined from engineering records, as follows:_______.

Production Departments Gasoline Engine Diesel Engine

Fabrication Department 6.0 dlh 4.0 dlh

Assembly Department 4.0 6.0

Direct labor hours per unit 10.0 dlh 10.0 dlh

a. Determine the per-unit factory overhead allocated to the gasoline and diesel engines under the single plantwide factory overhead rate method, using direct labor hours as the activity base.

b. Determine the per-unit factory overhead allocated to the gasoline and diesel engines under the multiple production department factory overhead rate method, using direct labor hours as the activity base for each department.

c. Recommend to management a product costing approach, based on your analyses in (a) and (b). Support your recommendation.

Answers

Answer:

Nova Industries Inc.

Factory Overhead allocated:

a. Under the single plantwide factory overhead cost per direct hours:

Overhead allocated to Gasoline Engine Diesel Engine

Direct labor hours (10 each) $800 $800

b. Under the multiple production department factory overhead rate method:

Overhead allocated to Gasoline Engine Diesel Engine

Total overhead allocated $860 $740

c. The multiple production department overhead rate method is recommended. It takes into account the activity usage by each department and looks fairer.

Explanation:

a) Data and Calculations:

factory overhead was budgeted for Nova:

Fabrication Department factory overhead $440,000

Assembly Department factory overhead 200,000

Total $640,000

Direct labor hours were estimated as follows:______.

Fabrication Department 4,000 hours

Assembly Department 4,000 hours

Total 8,000 hours

In addition, the direct labor hours (dlh) used to produce a unit of each product in each department were determined from engineering records, as follows:_______.

Production Departments Gasoline Engine Diesel Engine

Fabrication Department 6.0 dlh 4.0 dlh

Assembly Department 4.0 6.0

Direct labor hours per unit 10.0 dlh 10.0 dlh

Plantwide per unit factory overhead = Total overhead costs/Total direct labor hours

= $640,000/8,000 = $80

a. Overhead allocated to Gasoline Engine Diesel Engine

Direct labor hours (10 each) $800 ($80 * 10) $800 ($80 * 10)

Multiple production department per unit factory overhead:

Fabrication Department factory overhead $440,000/4,000 = $110

Assembly Department factory overhead 200,000/4,000 = $50

b. Overhead allocated to Gasoline Engine Diesel Engine

Fabrication Department $660 (6.0 * $110) $440 (4.0 * $110)

Assembly Department 200 (4.0 * $50) 300 (6.0 * $50)

Total overhead allocated $860 $740

Following are the solution to the given points:

For point a:

[tex]\text{Plantwide overhead rate} = \frac{\text{Total factory overhead}}{\text{Total direct labor hours}}[/tex]

[tex] = \frac{\$560,000}{ 8,000}\\\\= \$70 \ / DLH [/tex]

Calculating the value of gasoline engine[tex]= (4 \times \$70)=\$280\ / unit [/tex]

Calculating the value of diesel engine[tex]= (4 \times \$70)= \$280 / unit[/tex]

For point b:

Calculating the value of gasoline engine:

[tex]=[(1.20\times 100) + (2.80 \times \$40)] \\\\ =\$232 / unit [/tex]

Calculating the value of diesel engines:

[tex]=[(2.80\times \$100) + (1.20 \times \$40)]\\\\ =\$328 / unit [/tex]

Calculating the value of departmental overhead rate:

Calculating the value of fabrication:

[tex]= (\frac{\$400,000}{ 4,000}) \\\\ = \$100 / DLH [/tex]

Calculating the value of assembly:

[tex] = (\frac{\$160,000}{ 4,000}) \\\\ = \$40 / DLH[/tex]

For point c:

The Multiple department factory overhead rate method of allocating overhead costs should be chosen by management. Per the Single plantwide factory overhead rate technique, both items have the same manufacturing cost per unit. The direct work hours are now used differently with each product. Hence, by accounting for overhead in every production department independently, this multiple department price method avoids cost distortions.Learn more:

brainly.com/question/16711117

Related Questions

Paula Judge owns Judge Creative Designs. The trial balance of the firm for January 31, 2019, the first month of operations, is shown below. End-of-the-month adjustments must account for the following items: Supplies were purchased on January 1, 2019; inventory of supplies on January 31, 2019, is $1,600. The prepaid advertising contract was signed on January 1, 2019, and covers a four-month period. Rent of $2,100 expired during the month. Depreciation is computed using the straight-line method. The equipment has an estimated useful life of 10 years with no salvage value. Required: Complete the worksheet for the month. Prepare an income statement, statement of owner’s equity, and balance sheet. No additional investments were made by the owner during the month. Journalize and post the adjusting entries. Analyze: If the adjusting entries had not been made for the month, would net income be overstated or understated?

Answers

Question Completion:

Judge Creative Designs

Trial Balance as of January 31, 2019:

Account Titles Debit Credit

Cash $34,900

Accounts receivable 12,000

Supplies 6,550

Prepaid Advertising 6,000

Prepaid Rent 15,600

Equipment 40,800

Accumulated Depreciation 0

Accounts Payable 14,950

Capital account 59,400

Drawing account 6,400

Fees Income 58,100

Advertising Expense

Depreciation

Expense- Equipment

Rent Expense

Salaries Expense 9,100

Supplies Expense

Utilities Expense 1,100

Totals $132,450 $132,450

Answer:

Judge Creative Designs:

1. Adjusted Trial Balance as of January 31, 2019:

Judge Creative Designs

Trial Balance as of January 31, 2019:

Account Titles Debit Credit

Cash $34,900

Accounts receivable 12,000

Supplies 1,600

Prepaid Advertising 4,500

Prepaid Rent 13,500

Equipment 40,800

Accumulated Depreciation $340

Accounts Payable 14,950

Capital account 59,400

Drawing account 6,400

Fees Income 58,100

Advertising Expense 1,500

Depreciation

Expense- Equipment 340

Rent Expense 2,100

Salaries Expense 9,100

Supplies Expense 4,950

Utilities Expense 1,100

Totals $132,790 $132,790

2. Income Statement for the month ended January 31, 2019:

Fees Income $58,100

Advertising Expense $1,500

Depreciation

Expense- Equipment 340

Rent Expense 2,100

Salaries Expense 9,100

Supplies Expense 4,950

Utilities Expense 1,100

Total expenses 19,090

Net income $39,010

3. Statement of Owners' Equity for the month ended January 31, 2019:

Capital account $59,400

Net income 39,010

Drawing account (6,400)

Equity balance $92,010

4. Balance Sheet as of January 31, 2019:

Assets:

Cash $34,900

Accounts receivable 12,000

Supplies 1,600

Prepaid Advertising 4,500

Prepaid Rent 13,500

Equipment 40,800

Accumulated Depreciation (340)

Total assets $106,960

Liabilities + Equity:

Accounts Payable $14,950

Capital account 92,010

Total liabilities and equity $106,960

5. Adjusting Journal Entries:

1. Debit Supplies Expense $4,950

Credit Supplies $4,950

To record the supplies expense.

2. Debit Advertising Expense $1,500

Credit Prepaid Advertising $1,500

To record the advertising expense.

3. Debit Rent Expense $2,100

Credit Prepaid Rent $2,100

To record rent expense for the month.

4. Debit Depreciation Expense $340

Credit Accumulated Depreciation $340

To record depreciation expense for the month.

6. Total adjusting expenses = $8,890. The net income would have been overstated by $8,890.

Explanation:

a) Data and Adjustments:

1. Supplies Expense $4,950 Supplies $4,950 ($6,550 - $1,600) Balance $1,600

2. Advertising Expense $1,500 Prepaid Advertising $1,500 ($6,000/4) Balance $4,500

3. Rent Expense $2,100 Prepaid Rent $2,100 Balance $13,500 ($15,600 - $2,100)

4. Depreciation Expense $340 Accumulated Depreciation $340 ($40,800 * 10% * 1/12)

Data for January for Bondi Corporation and its two major business segments, North and South, appear below: Sales revenues, North $ 561,000 Variable expenses, North $ 325,500 Traceable fixed expenses, North $ 67,100 Sales revenues, South $ 433,200 Variable expenses, South $ 247,100 Traceable fixed expenses, South $ 56,000 In addition, common fixed expenses totaled $151,900 and were allocated as follows: $78,900 to the North business segment and $73,000 to the South business segment. A properly constructed segmented income statement in a contribution format would show that the segment margin of the North business segment is:

Answers

Answer:

[tex]561000 + 433200 + 78900 + 73000 = [/tex]

[tex]561000 + 433200 + 78900 + 73000 = [/tex]

Solomon has a balance of $4,000 on his credit card account, which has a minimum payment requirement of 4 percent. What is the minimum payment on his accoun

Answers

Abbot Inc. is considering the following investment opportunities. Required Compute the future value under each of the investment options. Round interest rate percentages to two decimal places in your calculations (for example, enter .0063 for .6333333%). Round final answer to the nearest whole dollar (for example, enter final answer 2,556 for 2,555.5678). Do not use a negative sign with your answers. Annual Interest Term Future Investment Compounding Rate Cost (Years) Value Investment A Semiannually 6% $50,000 5 $ 67,196 Investment B Quarterly 8% 60,000 10 132,482 Investment C Monthly 10% 40,000 8 88,727 X Investment D Monthly 5% 80,000 10 131,761 x

Answers

Answer:

$ 67,196

$132482

$88,727

$131,761

Explanation:

The formula for calculating future value:

FV = P (1 + r/m)^mn

FV = Future value

P = Present value

R = interest rate

N = number of years

m =number of compounding

$50,000 x ( 1 + 0.06/2)^10 = $67,196

$60,000 x ( 1 + 0.08/4)^40 = $132,482

$40,000 x (1 + 0.1/12)^96 = $88,727

$80,000 x ( 1 + 0.05 /12) ^120 = $131,761

Value Catering uses two measures of activity, jobs and meals, in the cost formulas in its budgets and performance reports. The cost formula for catering supplies is $500 per month plus $76 per job plus $14 per meal. A typical job involves serving a number of meals to guests at a corporate function or at a host's home. The company expected its activity in June to be 17 jobs and 147 meals, but the actual activity was 13 jobs and 144 meals. The actual cost for catering supplies in June was $3,340. The catering supplies in the planning budget for June would be closest to:

Answers

Answer:

$3,504

Explanation:

Catering supplies = $500 + $76 x j + $14 x m

where,

j = number of jobs in a month

m = number of meals in a month

therefore,

Planning budget for June, use the Actual number of jobs and meals into the formula (Actual Activity).

June Catering supplies = $500 + $76 x 13+ $14 x 144

= $3,504

Conclusion

The catering supplies in the planning budget for June would be closest to $3,504.

The mythical Three Floyds Brewery in Munster, Indiana makes a beer called Zombie Dust, which it sells in large bottles to pubs and stores in the Midwest. The setup cost of brewing and bottling a batch of beer is $1,800 per setup. The holding cost of storing a bottle of beer is $2.50 per year. The annual demand for Zombie Dust is 20,000 bottles. Three Floyds Brewery can brew and bottle beer at the rate of 400 bottles per day. The brewery operates 250 days per year and currently produces Zombie Dust in batches of 10,000 bottles.

a. What is the annual holding and setup cost of their current production schedule?

b. What is the economic production quantity (EPQ)?

c. What is the cost difference between the current production schedule and the EPQ?

Answers

Answer:

Setup cost (S) = 1800

Holding cost (H) = 2.5

Annual demand (D) = 20000

Daily demand (d) = Annual demand / Number of working days = 20000 bottles/250 = 80 bottles daily

Daily production (p) = 400

a. Given production quantity Q = 10000

Holding cost = 1/2*[(p-d)/p]*QH

Holding cost = ((400-80)/(2*400))*10000 *2.5= 10000

Ordering cost = (D/Q)S = (20000/10000)*1800 = 3600

Total Cost = Annual holding cost + Annual ordering Cost = 10000 + 3600 = 13600

b. Economic production Quantity (EPQ) = Q

Q = √2DS/H √p/p-d

Q = √2*20000*1800/2.5 √400 / 400-80

Q = 6000 bottles

Holding cost = 1/2*[(p-d)/p]*QH

Holding cost = ((400-80)/(2*400))*6000 *2.5= 6000

Ordering cost = (D/Q)S = (20000/6000)*1800 = 6000

Total Cost = Annual Holding cost + Annual ordering cost = 6000 + 6000 = 12000

C. Cost difference between the current production schedule and the EPQ = 13600 - 12000 = 1600

Morris Company applies overhead based on direct labor costs. For the current year, Morris Company estimated total overhead costs to be $400,000, and direct labor costs to be $2,000,000. Actual overhead costs for the year totaled $380,000, and actual direct labor costs totaled $1,800,000. At year-end, the balance in the Factory Overhead account is a:_________.

a. $360,000 Debit balance.

b. $20,000 Credit balance.

c. $400,000 Credit balance.

d. $20,000 Debit balance.

e. $380,000 Debit balance.

Answers

Answer:

Option d ($20,000 Debit balance) is the appropriate option.

Explanation:

The given values are:

Total overhead costs,

= $400,000

Direct labor costs,

= $2,000,000

Actual overhead incurred,

= $380,000

Actual direct labor costs,

= $1,800,000

Now,

As a % of labor cost, the OH will be:

= [tex]\frac{400000}{2000000}\times 100[/tex]

= [tex]20 \ percent[/tex]

The absorbed overhead will be:

= [tex]1800000\times 20 \ percent[/tex]

= [tex]360,000[/tex]

Then,

The balance in overhead account will be:

= Actual overhead incurred - Absorbed overhead

= [tex]380000 - 360000[/tex]

= [tex]20,000[/tex] ($) (Debit balance)

Bakery A sells bread for $2 per loaf that costs $0.50 per loaf to make. Bakery A gives an 80% discount for its bread at the end of the day. Demand for the bread is normally distributed with a mean of 300 and a standard deviation of 30. What order quantity maximizes expected profit for Bakery A

Answers

Answer:

324

Explanation:

Calculation to determine What order quantity maximizes expected profit for Bakery A

First step is for the Salvage value

Salvage value = $2 × (1 - 80%)

Salvage value= $0.40

Second step is to calculate the Overage cost

Overage cost = $0.50 - $0.40

Overage cost = $0.10

Second step is to calculate the Underage cost

Underage cost = $2 - $0.50

Underage cost = $1.50

Third step is to calculate the The critical ratio

The critical ratio = 1.5/(1.5 + 0.4) = 0.79. z = 0.8

Now let calculate the Order quantity

Order quantity = 300 + (0.8× 30)

Order quantity= 324

Therefore the order quantity maximizes expected profit for Bakery A is 324

Waterway Resort opened for business on June 1 with eight air-conditioned units. Its trial balance on August 31 is as follows. WATERWAY RESORT TRIAL BALANCE AUGUST 31, 2020 Debit Credit Cash $25,300 Prepaid Insurance 10,200 Supplies 8,300 Land 28,000 Buildings 128,000 Equipment 24,000 Accounts Payable $10,200 Unearned Rent Revenue 10,300 Mortgage Payable 68,000 Common Stock 104,700 Retained Earnings 9,000 Dividends 5,000 Rent Revenue 84,200 Salaries and Wages Expense 44,800 Utilities Expenses 9,200 Maintenance and Repairs Expense 3,600 $286,400 $286,400 Other data: 1. The balance in prepaid insurance is a one-year premium paid on June 1, 2020. 2. An inventory count on August 31 shows $445 of supplies on hand. 3. Annual depreciation rates are (a) buildings (4%) (b) equipment (10%). Salvage value is estimated to be 10% of cost. 4. Unearned Rent Revenue of $4,172 was earned prior to August 31. 5. Salaries of $365 were unpaid at August 31. 6. Rentals of $843 were due from tenants at August 31. (Use Accounts Receivable account.) 7. The mortgage interest rate is 8% per year.

Answers

Question Completion:

Journalize the adjusting entries for the three months of 2020.

Answer:

Waterway Resort

Adjusting Journal Entries:

No. Date Account Titles and Explanation Debit Credit

1. Aug. 31 Insurance Expense $2,550

Prepaid Insurance $2,550

To record insurance expense for the three months' period.

2. Aug. 31 Supplies Expense $7,855

Supplies $7,855

To record supplies expense for the three months' period.

3. Aug. 31 Depreciation Expense - Building $1,280

Accumulated Depreciation - Building $1,280

To record depreciation expense for the three months' period.

3. Aug. 31 Depreciation Expense-Equipment $540

Accumulated Depreciation - Equipment $540

To record depreciation expense for the three months' period.

4. Aug. 31 Unearned Rent Revenue $4,172

Rent Revenue $4,172

To record rent revenue earned.

5. Aug. 31 Salaries Expense $365

Salaries Payable $365

To record accrued salaries expense.

6. Aug. 31 Accounts Receivable $843

Rent Revenue $843

To record accounts receivable due.

7. Aug. 31 Interest Expense $1,360

Interest Payable $1,360

To record mortgage interest expense.

Explanation:

a) Data and Calculations:

WATERWAY RESORT TRIAL BALANCE AUGUST 31, 2020

Debit Credit

Cash $25,300

Prepaid Insurance 10,200

Supplies 8,300

Land 28,000

Buildings 128,000

Equipment 24,000

Accounts Payable $10,200

Unearned Rent Revenue 10,300

Mortgage Payable 68,000

Common Stock 104,700

Retained Earnings 9,000

Dividends 5,000

Rent Revenue 84,200

Salaries and Wages Expense 44,800

Utilities Expenses 9,200

Maintenance and Repairs Expense 3,600

Totals $286,400 $286,400

b) Adjusting transactions:

1. Insurance Expense $2,550 Prepaid Insurance $2,550 ($10,200 * 3/12)

2. Supplies Expense $7,855 Supplies $7,855 ($8,300 - $445)

3. Depreciation Expense - Building $1,280 Accumulated Depreciation - Building $1,280 ($128,000 * 4% * 3/12)

3. Depreciation Expense - Equipment $540 Accumulated Depreciation - Equipment $540 ($24,000 -$2,400 * 10% * 3/12)

4. Unearned Rent Revenue $4,172 Rent Revenue $4,172

5. Salaries Expense $365 Salaries Payable $365

6. Accounts Receivable $843 Rent Revenue $843

7. Interest Expense $1,360 Interest Payable $1,360 ($68,000 * 8% * 3/12)

Find the amount to which $600 will grow under each of these conditions: 8% compounded annually for 3 years. Do not round intermediate calculations. Round your answer to the nearest cent. $ 8% compounded semiannually for 3 years. Do not round intermediate calculations. Round your answer to the nearest cent. $ 8% compounded quarterly for 3 years. Do not round intermediate calculations. Round your answer to the nearest cent. $ 8% compounded monthly for 3 years. Do not round intermediate calculations. Round your answer to the nearest cent. $ 8% compounded daily for 3 years. Assume 365-days in a year. Do not round intermediate calculations. Round your answer to the nearest cent.

Answers

Answer:

Future values:

a. $755.83

b. $759.19

c. $760.95

d. $762.14

e. $762.75

Explanation:

a) Data and Calculations:

Present value = $600

Conditions:

1. 8% compounded annually for 3 years:

N (# of periods) = 3

I/Y (Interest per year) = 8

PV (Present Value) = $600

PMT (Periodic Payment) = $ 0

FV = $755.83

Total Interest = $155.83

2. 8% compounded semiannually for 3 years.

N (# of periods) = 6

I/Y (Interest per year) = 4

PV (Present Value) = $600

PMT (Periodic Payment) = $ 0

FV = $759.19

Total Interest $159.19

3. 8% compounded quarterly for 3 years.

N (# of periods) = 12

I/Y (Interest per year) = 2

PV (Present Value) = $600

PMT (Periodic Payment) = $ 0

FV = $760.95

Total Interest $160.95

4. 8% compounded monthly for 3 years.

N (# of periods) = 36

I/Y (Interest per year) = 0.66667%

PV (Present Value) = $600

PMT (Periodic Payment) = $0

FV = $762.14

Total Interest = $162.14

5. 8% compounded daily for 3 years. Assume 365-days in a year.

N (# of periods) = 1,095

I/Y (Interest per year) = 0.02192%

PV (Present Value) = $600

PMT (Periodic Payment) = $0

FV = $762.75

Total Interest $162.75

On January 1, a company issues bonds dated January 1 with a par value of $230,000. The bonds mature in 5 years. The contract rate is 7%, and interest is paid semiannually on June 30 and December 31. The market rate is 6% and the bonds are sold for $239,811. The journal entry to record the issuance of the bond is:

Answers

Answer:

Debit : Cash $239,811

Credit : Bonds Payable $239,811

Explanation:

Step 1

First, lets determine the price of Bonds at issuance date (1 January). This is because Bonds are issued at their Issue Price not Par Value.

The Price of the Bond is its present value (PV) and this is calculated as :

FV = $230,000

PMT = ($230,000 x 7 %) ÷ 2 = $8,050

N = 5 x 2 = 10

P/YR = 2

R = 6%

PV = ?

Thus, the Present Value (PV) of the Bonds is $239,811.

Step 2

The journal entry to record the issuance of the bond is:

Debit : Cash $239,811

Credit : Bonds Payable $239,811

Pharoah Corporation factors $251,700 of accounts receivable with Kathleen Battle Financing, Inc. on a with recourse basis. Kathleen Battle Financing will collect the receivables. The receivables records are transferred to Kathleen Battle Financing on August 15, 2020. Kathleen Battle Financing assesses a finance charge of 2% of the amount of accounts receivable and also reserves an amount equal to 4% of accounts receivable to cover probable adjustments. (b) Assume that the conditions are met for a transfer of receivables with recourse to be accounted for as a sale. Prepare the journal entry on August 15, 2020, for Pharoah to record the sale of receivables, assuming the recourse obligation has a fair value of $5,010. (If no entry is required, select "No Entry" for the account titles and enter 0 for the amounts. Credit account titles are automatically indented when the amount is entered. Do not indent manually.)

Answers

Answer:

Cash received (251,700*94%) $236,598

Add: Due from factor (251,700*4%) $10,068

Less: Recourse obligation $5,010

Net proceeds $241,656

Gain/Loss = Carrying value - Net proceeds

Gain = $251,700 - $241,656

Gain = $10,044

Journal entry

Date Account Titles Debit Credit

Aug 15,2020 Cash $236,588

Due from factors $10,068

Gain on sale of receivables $10,044

Recourse liability $5,010

Account receivable $251,700

define liquidity economics.

Answers

Answer:

Liquidity refers to the ease with which an asset, or security, can be converted into ready cash without affecting its market price. Cash is the most liquid of assets while tangible items are less liquid. The two main types of liquidity include market liquidity and accounting liquidity.

Kally goes to the grocery store each week looking to purchase items that will give her as much utility as possible, given her $100 budget. Last week apples were priced at $4.50 each, and Kally purchased 3 apples. This week apples are on sale for $2.50 each, while all other prices have remained the same, and Kally chooses to purchase 7 apples. Given this information, plot Kally's demand curve for apples.

Answers

Answer:

Please check the attached image for kally's demand curve

Explanation:

The demand curve is a curve that shows the various quantities of a good that is purchased at different prices.

The demand curve is downward sloping due to the inverse relationship between price and quantity demanded. The higher the price, the lower the quantity demanded and the lower the price, the higher the quantity demanded. This is known as the law of demand.

It can be seen that the quantity demanded of apples increased from 3 to 7 when price reduced to $2.50

On the demand curve, price is on the vertical axis, while quantity demanded is on the horizontal axis

Answer:

Please check the attached image for kally's demand curve

Explanation:

The main reason the usefulness of Pareto optimal policies is limited as a policy guide is that: Question 2 options: it is too subjective. it is only objective, and good policy also requires a subjective element. real-world changes in which no one is harmed are rare or nonexistent. real-world changes in which more people are helped than are harmed are rare.

Answers

Answer:

real-world changes in which no one is harmed are rare or nonexistent.

Explanation:

Pareto optimality, also known as Pareto efficiency was named after Vilfredo Pareto and it refers to an economic system in which no additional changes can make a person better off without making at least one person worse off.

This ultimately implies that, when there's a maximum level of efficiency in the allocation of goods and resources in an economy and no further changes can be made without making at least one person worse off. Thus, it can only exist in theory but not in reality.

The main reason the usefulness of Pareto optimal policies is limited as a policy guide is that real-world changes in which no one is harmed are rare or nonexistent because the goods and resources cannot be reallocated.

With regard to the types of interviews: A. Reference-based interviews are best at predicting sales success. B. Situation-based interviews pose questions about past situations to predict how the candidate might respond in the future. C. Behavior and situation based interviews are highly unstructured. D. Performance based interviews are interviews conducted by senior salespeople in the field. E. None of these is correct.

Answers

Answer:

can you put a picture might be easier to read it

The statement that asserts a true claim regarding kinds of interviews would be:

E). None of these is correct.

What is an Interview?

"Interview" is described as the conversation that is taken personally and a set of questions have been asked for a publication or channel.

The given statements assert incorrect claims regarding the various types of interviews.

The reference-based interviews are taken when a person is referred by another to get a better understanding of the caliber and capability of his/her.

While Situation-based interviews pose a hypothetical situation and behavior interviews observe particular behavioral patterns.

Thus, option E is the correct answer.

Learn more about "Interview" here:

brainly.com/question/7638386

On December 31, 2017, Extreme Fitness has adjusted balances of $980,000 in Accounts Receivable and $91,000 in Allowance for Doubtful Accounts. On January 2, 2018, the company learns that certain customer accounts are not collectible, so management authorizes a write-off of these accounts totaling $28,000. What amount would the company report as its net accounts receivable on December 31, 2017

Answers

Answer:

Account receivable = $889,000

Explanation:

The company would record as net receivables, the total amount on accounts receivable less total amount on the allowance for uncollectible account.

The above means that the balance would represent the amount of credit that has gone bad hence the value represent balance on net receivable account.

Therefore,

Accounts receivable

= Adjusted balance in accounts receivable - Allowance for doubtful account

= $980,000 - $91,000

= $889,000

Among the ethical and social challenges facing operations managers are a. honoring community commitments b. maintaining a clean environment c. developing safe quality products d. providing a safe workplace e. all of the above

Answers

Answer:

e. all of the above

Explanation:

There are several ethical and social challenges that managers need to face today. As organizations are perceived as institutions that promote economic and social well-being and there is a greater demand for measures to protect the environment and society, organizations need to adapt their processes and make the work environment increasingly better, using management practices that promote continuous improvement and reduce productive impacts on the environment. There is a need for security in products, processes, the workplace, transparency in government actions and support for the local community. So it is correct to say that all the alternatives are correct.

Question 5 of 10

When should a writer establish common ground before the bottom-line

statement?

A. When the report does not have an executive summary

O B. When the document is minutes of a meeting

Ο Ο Ο Ο

C. When the reader may disagree with the bottom-line statement

O D. When the details are arranged in order of importance

SUBMIT

Answers

Answer:

C. When the reader may disagree with the bottom-line statement

Explanation:

A common ground can be regarded as an area of shared interests which is been held number of people or groups. It is a point at which opinions and interest is been agreed upon by parties. A bottom-line statement can be regarded as a likely closing statement made after an agreement has been reached, it's just like a conclusion after the whole statement. Hence, it is necessary for the writer to establish a common ground first before he/she will establish bottom line statement "when the reader may disagree with the bottom-line statement''

Sandhill Company reports the following financial information before adjustments. Dr. Cr. Accounts Receivable $132,500 Allowance for Doubtful Accounts $3,970 Sales Revenue (all on credit) 838,100 Sales Returns and Allowances 50,780 Prepare the journal entry to record bad debt expense assuming Sandhill Company estimates bad debts at (a) 5% of accounts receivable and (b) 5% of accounts receivable but Allowance for Doubtful Accounts had a $1,630 debit balance. (If no entry is required, select "No Entry" for the account titles and enter 0 for the amounts. Credit account titles are automatically indented when the amount is entered. Do not indent manually.)

Answers

Answer:

S/n Accounts title Debit Credit

a. Bad Debt expenses $2,655

Allowance for Doubtful debts $2,655

((132,500*5%)-3,970)

(Being bad debt expense recorded)

b. Bad Debt expenses $8,255

Allowance for Doubtful debts $8,255

{(132,500*5%)+1,630]

(Being bad debt expense recorded)

A municipal bond has yield to maturity of 4.83 percent. An investor with a marginal tax rate of 35 percent is indifferent between this municipal bond and an otherwise identical taxable corporate bond. What is the yield to maturity of the corporate bond

Answers

Answer: 7.43%

Explanation:

The yield to maturity simply refers to the total return that is expected on a bond as long as the bond is held till it matures.

In this case, since the investor is indifferent between this municipal bond and an otherwise identical taxable corporate bond, the yield to maturity of the corporate bond will be:

4.83% = Corporate bond YTM × ( 1- 35%)

4.83% = Corporate bond YTM × 65%

Corporate bond YTM = 4.83% / 65%

Corporate bond YTM = 0.0483/0.65

Corporate bond YTM = 7.43%

The yield to maturity of the corporate bond is 7.43%

The following costs related to Wintertime Company for a relevant range of up to 20,000 units annually: Variable Costs: Direct materials $2.50 Direct labor 0.75 Manufacturing Overhead 1.25 Selling and administrative 1.50 Fixed Costs: Manufacturing overhead $10,000 Selling and Administrative 5,000 The selling price per unit of product is $15.00. At a sales volume of 15,000 units, what is the total profit for Wintertime Company

Answers

Answer:

$120,000

Explanation:

The total profit for Winter company is computed as seen below

($15 × 15,000 units) - [$10,000 + $5,000(($2.50 + $0.75 + $1.25 + $1.50)15,000)]

= $225,000 - [$5,000 + ($6 × 15,000)]

= $225,0000 - $105,000

= $120,000

Swifty Hardware reported cost of goods sold as follows. 2022 2021 Beginning inventory $ 31,000 $ 21,500 Cost of goods purchased 203,500 153,000 Cost of goods available for sale 234,500 174,500 Less: Ending inventory 35,000 31,000 Cost of goods sold $199,500 $143,500 Swifty made two errors: 1. 2021 ending inventory was overstated by $3,600. 2. 2022 ending inventory was understated by $6,550. Compute the correct cost of goods sold for each year. 2022 2021 Cost of goods sold

Answers

Answer:

See below

Explanation:

1. Correct amount of cost of goods sold 2022

= beginning inventory + cost of goods purchased - correct ending inventory

= $31,000 + $203,500 - ($35,000 - $6,550)

= $234,500 - $28,450

= $206,050

2.Correct amount of cost of goods sold 2021

= $21,500 + $153,000 - ($31,000 - $3,600)

= $139,900

Below are the transactions for Ute Sewing Shop for March, the first month of operations.

March 1 Issue common stock in exchange for cash of $1,400.

March 3 Purchase sewing equipment by signing a note with the local bank, $1,100.

March 5 Pay rent of $440 for March.

March 7 Martha, a customer, places an order for alterations to several dresses. Ute estimates that the alterations will cost Martha $640. Martha is not required to pay for the alterations until the work is complete.

March 12 Purchase sewing supplies for $114 on account. This material will be used to provide services to customers.

March 15 Ute delivers altered dresses to Martha and receives $640.

March 19 Ute agrees to alter 10 business suits for Bob, who has lost a significant amount of weight recently. Ute receives $540 from Bob and promises the suits to be completed by March 25.

March 25 Ute delivers 10 altered business suits to Bob.

March 30 Pay utilities of $79 for the current period.

March 31 Pay dividends of $70 to stockholders.

1. Record each transaction.

2. Post each transaction to the appropriate T-accounts.

3. Calculate the balance of each account at March 31.

4. Prepare a trial balance as of March 31.

Ute uses the following accounts:

Cash, Supplies, Equipment, Accounts Payable, Deferred Revenue, Notes Payable, Common Stock, Dividends, Service Revenue, Rent Expense, and Utilities Expense.

Answers

Answer:

Part 1

March 1

Debit : Cash $1,400

Credit : Common Stock $1,400

March 3

Debit : Equipment $1,100

Credit : Note Payable $1,100

March 5

Debit : Rent Expense $440

Credit : Cash $440

March 7

No Entry

March 12

Debit : Supplies $114

Credit : Accounts Payable $114

March 15

Debit : Cash $640

Credit : Service Revenue $640

March 19

Debit : Cash $540

Credit : Deferred Revenue $540

March 25

Debit : Deferred Revenue $540

Credit : Service Revenue $540

March 30

Debit : Utilities Expense $79

Credit : Cash $79

March 31

Debit : Dividends $70

Credit : Cash $70

Part 2 and Part 3

Cash : Debit = $1,400 + $640 + $540 Credit = $440 + $79 + $70, Balance = 1,991 Debit

Common Stock : Debit = Credit = $1,400 , Balance = 1,400 Credit

Equipment : Debit = $1,100 Credit = , Balance = 1,110 Debit

Note Payable : Debit = Credit = $1,100 , Balance = 1,100 Credit

Rent Expense : Debit = $440 Credit = , Balance = $440 Debit

Supplies : Debit = $114 Credit = , Balance = $144 Debit

Accounts Payable : Debit = Credit = $114 , Balance = $114 Credit

Service Revenue : Debit = Credit = $640 + $540 , Balance = $1,180 Credit

Deferred Revenue : Debit = $540 Credit = $540 , Balance = $ 0

Utilities Expense : Debit = $79 Credit = , Balance = $79 Debit

Dividends : Debit = $70 Credit = , Balance = $70 Debit

Part 4

Sewing Shop

Trial balance as at March 31

Debit Credit

Cash $ 1,991

Common Stock $1,400

Equipment $1,110

Note Payable $1,100

Rent Expense $440

Supplies $144

Accounts Payable $114

Service Revenue $1,180

Deferred Revenue $ 0 $0

Utilities Expense $79

Dividends $70

Totals $3,864 $3,864

Explanation:

To successfully tackle the question, follow the steps :

Record journal entriesPost the Journals to Ledger Accounts Find the Ledger Account BalancesPrepare a Trial BalanceThe Trial Balance is used to check mathematical accuracy. It is a list of Debit and Credit extracted from Balances from the Ledger Accounts.

A stock currently sells for $49. The dividend yield is 3.4 percent and the dividend growth rate is 4.7 percent. What is the amount of the dividend to be paid in one year

Answers

Answer: $1.67

Explanation:

Current price of stock = $49

Dividend yield = 3.4%

Dividend growth rate = 4.7%

To get the amount of the dividend to be paid in one year, we calculate it as:

Dividend yield = Dividend for next period/Current price

=49 × 3.4%

= 49 × 0.034

=$1.67

Assume the single-factor model is applied to a security that has a negative factor beta. The security will: A) always have a positive rate of return. B) have an expected return greater than the risk-free rate. C) have an actual return that equals the risk-free rate. D) have an expected return equal to the market rate of return. E) have an actual rate of return that can be positive, negative, or zero.

Answers

Answer: E) have an actual rate of return that can be positive, negative, or zero.

Explanation:

When a single factor model like the Capital Asset Pricing Model is applied to a security with a negative beta, the returns shown could be negative, positive or even zero depending on the risk free rate and the market rate.

CAPM uses the aforementioned risk free rate, the market rate and the beta to calculate returns. The size of these variables could result in a return that is either negative, positive or zero.

For instance:

Beta = -1, Rf = 4%, Market rate = 7%

Return = 4% - 1 * ( 7% - 4%)

= 4% - 3%

= 1%

A positive return yet beta is negative. Return can change signs or be zero if figures are tweaked.

Louisiana Timber Company currently has 5 million shares of stock outstanding and will report earnings of $6.32 million in the current year. The company is considering the issuance of 1 million additional shares that will net $35 per share to the corporation. a. What is the immediate dilution potential for this new stock issue?

Answers

Answer:

0.214 per share

Explanation:

Calculation to determine the immediate dilution potential for this new stock issue

First step is to calculate the EPS before issuance

EPS before issuance = 6.32 / 5

EPS before issuance= 1.264

Second step is to calculate the EPS after new share issue

EPS after new share issue = 6.32 / (5+1)

EPS after new share issue=6.32/6

EPS after new share issue= 1.05

Now let calculate the Dilution potential

Dilution potential = 1.264 - 1.05

Dilution potential = 0.214 per share

Therefore the immediate dilution potential for this new stock issue is 0.214 per share

BBB Leasing purchased a machine for $390,000 and leased it to Jack Tupp Auto Repair on January 1, 2021. Lease description: Quarterly rental payments $24,408 at beginning of each period Lease term 5 years (20 quarters) No residual value; no BPO Economic life of machine 5 years Implicit interest rate 10% Fair value of asset $390,000 What is the balance in the lease payable account after the April 1, 2021, lease payment

Answers

Answer:

$350,324

Explanation:

total lease liability = $390,000

since the first payment is made on January 1, the carrying of lease liability = $390,000 - $24,408 = $365,592

the interest expense for the 3 months = $365,592 x 10% x 3/12 = $9,139.80 ≈ $9,140

carrying value of lease liability after second payment = $365,592 - ($24,408 - $9,140) = $365,592 - 15,268 = $350,324

Brian has a job. The first place he should look for health care coverage is because the costs will probably be the for the generous terms and coverage. Darnell does not have a job. He is a member of the alumni association of his alma mater. Darnell will probably find better coverage for a lower cost through plans offered by because plans spread the costs and risks among more people than plans do. To begin their research, Brian and Darnell should look at in order to .

Answers

Answer:

the company he works for

lowest

most

his alumni association

group

individual

indemnity and managed care plans

be thorough

Explanation:

Shen has a job. The first place he should look for health care coverage is his employer because the costs will probably be the most affordable for the generous terms and coverage. Yakov does not have a job. He is a member of the alumni association of his alma mater. Yakov will probably find better coverage for a lower cost through plans offered by health insurance exchanges because these plans spread the costs and risks among more people than individual plans do. To begin their research, Shen and Yakov should look at the websites of health insurance providers in order to compare different plans, costs, and coverage options.

In their pursuit of health care coverage, Shen and Yakov have distinct options based on their employment status. With a job, Shen's best initial choice lies with his employer-provided health insurance, likely offering affordable premiums and comprehensive coverage. Conversely, Yakov's absence of employment leads him to explore health insurance exchanges

As an alumnus, he may access plans with better coverage at lower costs since these plans distribute expenses and risks across a larger pool of individuals. Both should commence their research by reviewing the official websites of local health insurance providers, where they can compare various plans to make informed decisions that align with their specific needs and financial capabilities.

To know more about health insurance, click here.

https://brainly.com/question/28590419

#SPJ2

------------The given question is incomplete, the complete question is:

"FILL IN THE BLANK WITH THE CORRECT WORDS:

Shen has a job. The first place he should look for health care coverage is _____ because the costs will probably be the ______ for the generous terms and coverage. Yakov does not have a job. He is a member of the alumni association of his alma mater. Yakov will probably find better coverage for a lower cost through plans offered by ________ because ________ plans spread the costs and risks among more people than _______ plans do. To begin their research, Shen and Yakov should look at _______ in order to _____________."---------------

true or false. the demand curve for the product of a monopolist is the same as the demand curve for the industry.